Manage your cash flow in real time

with Business Intelligence

Connect your financial flows, anticipate cash needs, and secure your

strategic decisions.

Your Challenge

Where is your financial data stored?

More than 70% of companies manage treasury data across 3+ disconnected systems (banks, ERP, Excel, forecasting tools).

Why do forecasts often miss the mark?

Studies show over 60% of finance teams face significant gaps between forecasts and actuals, reducing predictability.

Are your financial decisions proactive or reactive?

Without real-time insights, 8 out of 10 CFOs admit decisions are taken too late, exposing the business to risks.

How much time do reports really take?

Manual Excel reports consume up to 40% of finance teams’ monthly workload, limiting time for analysis and strategy.

Result: increased risk of cash flow tensions and missed financing opportunities.

Our BI Solution

With DataVizX BI, cash flow becomes a strategic driver:

-

Data Integration

Connect internal financial data with banking flows: cash in/out, debt, and credit positions.

-

Centralized Financial View

Consolidate all treasury data into one single source of truth.

-

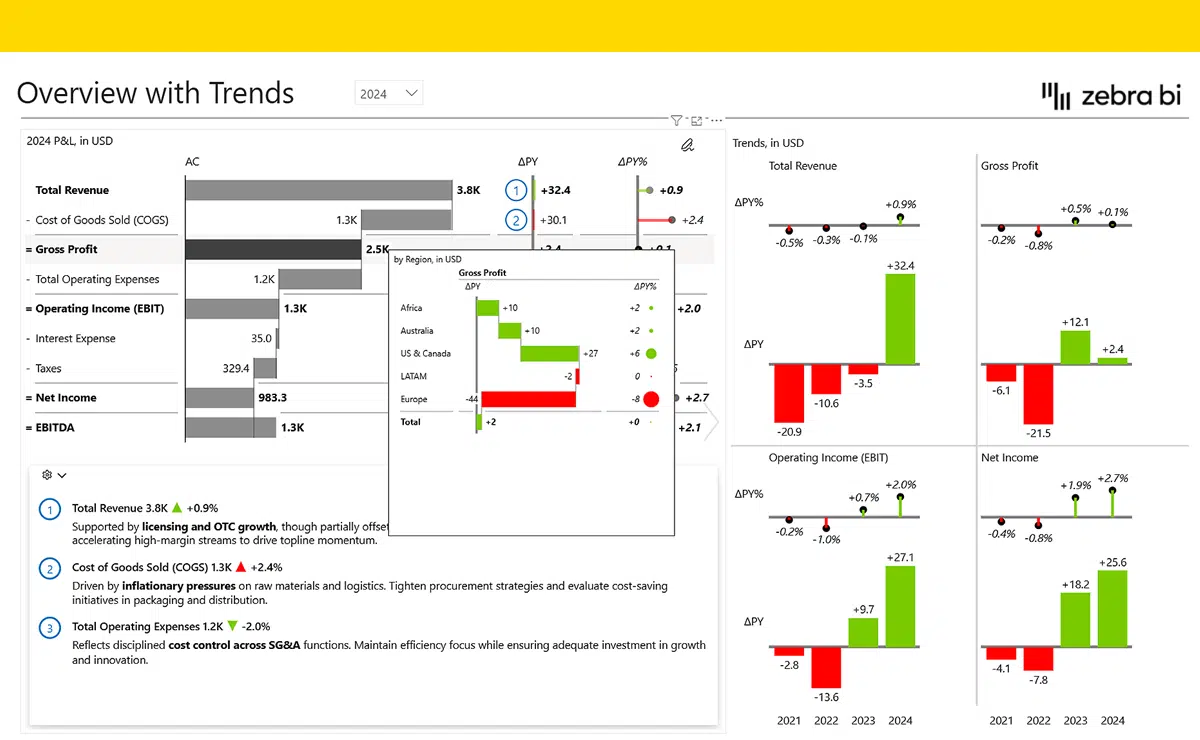

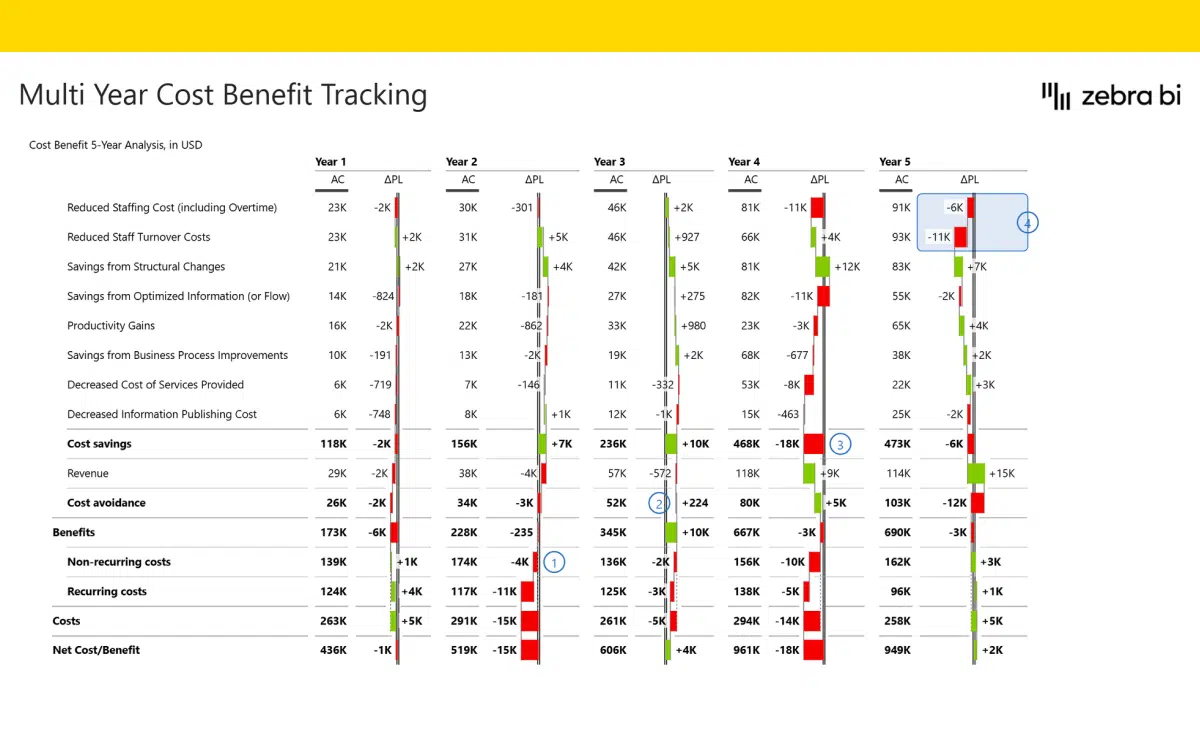

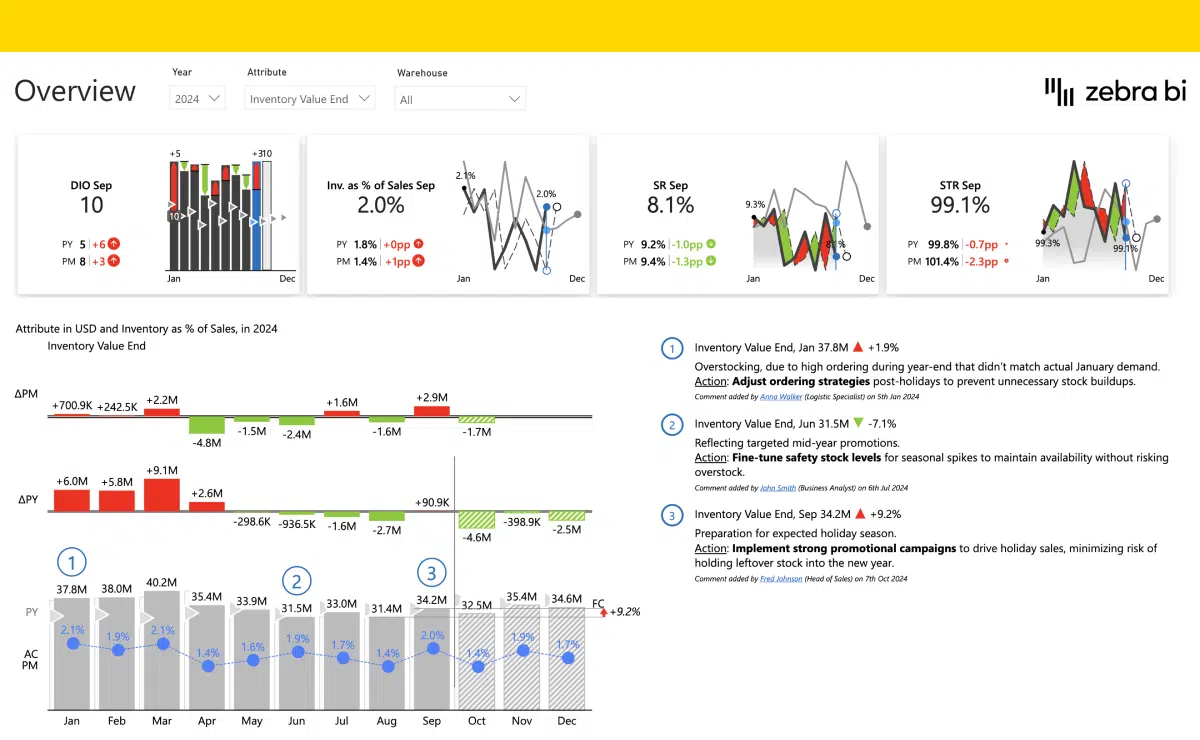

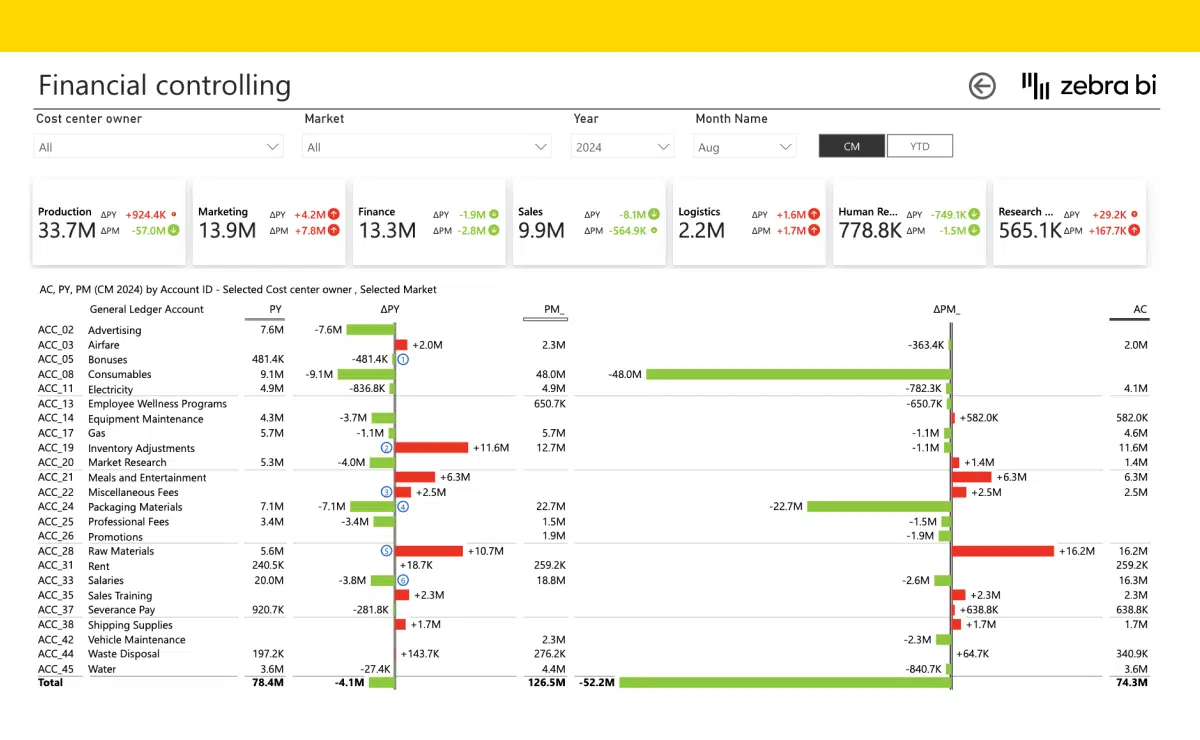

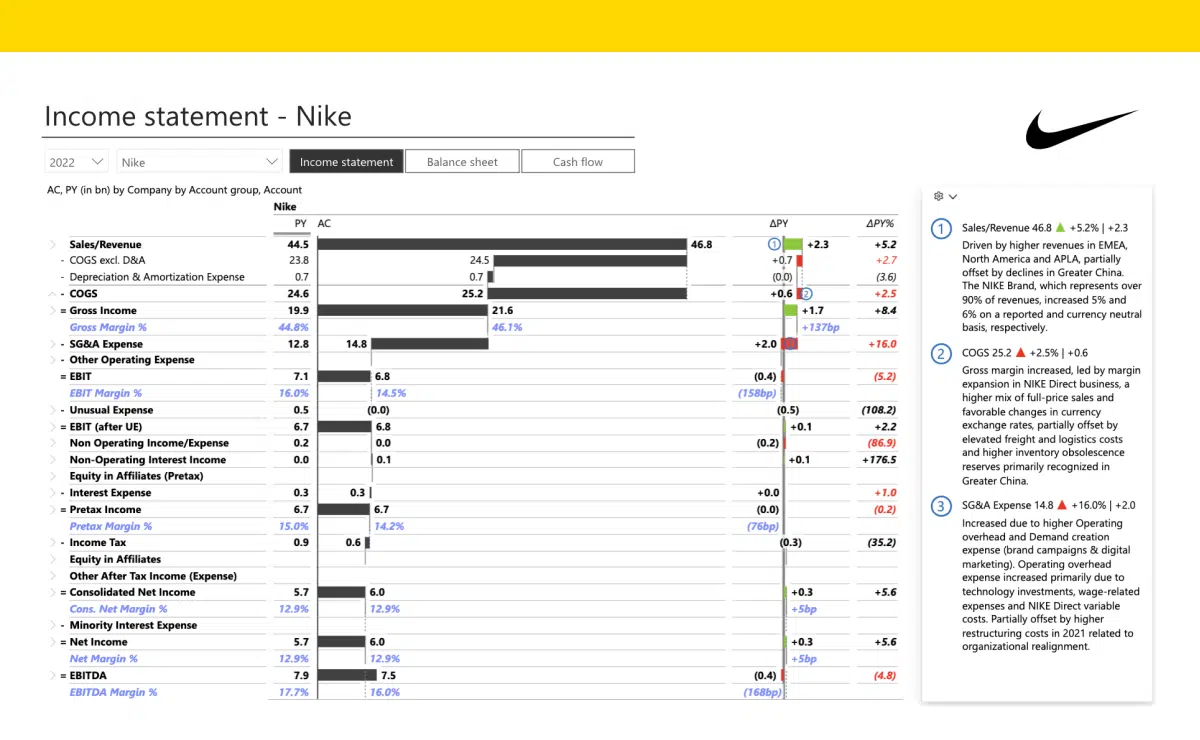

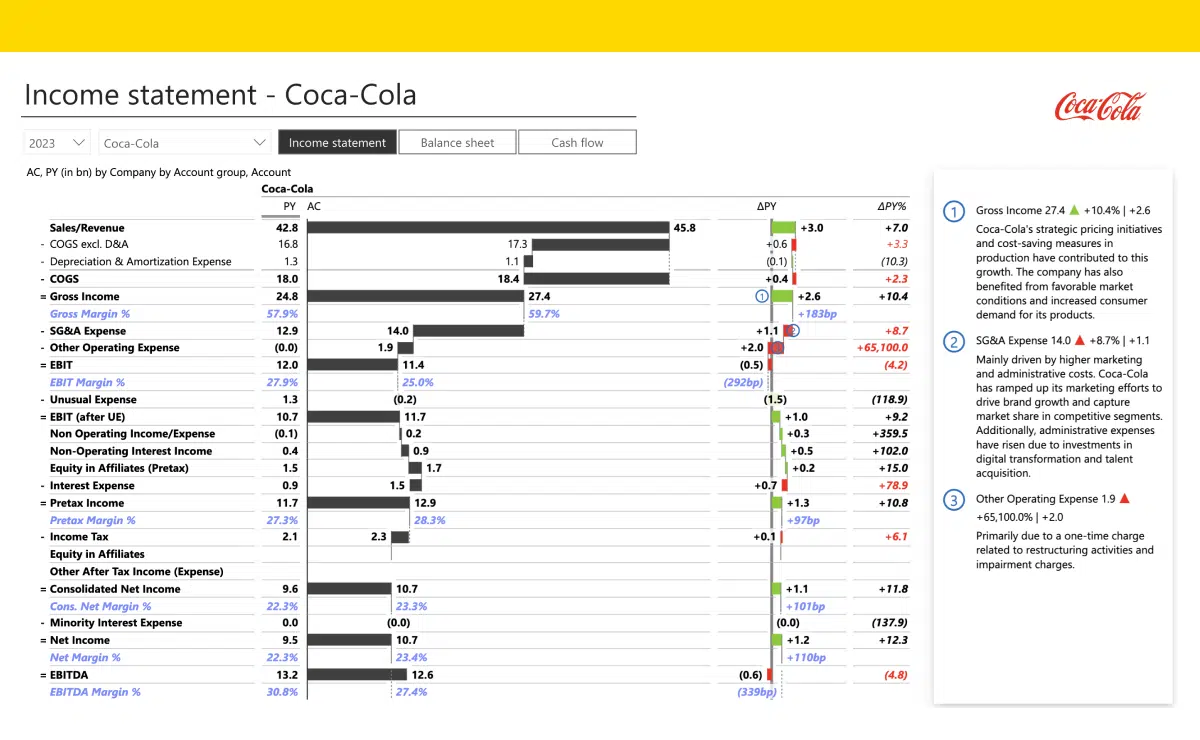

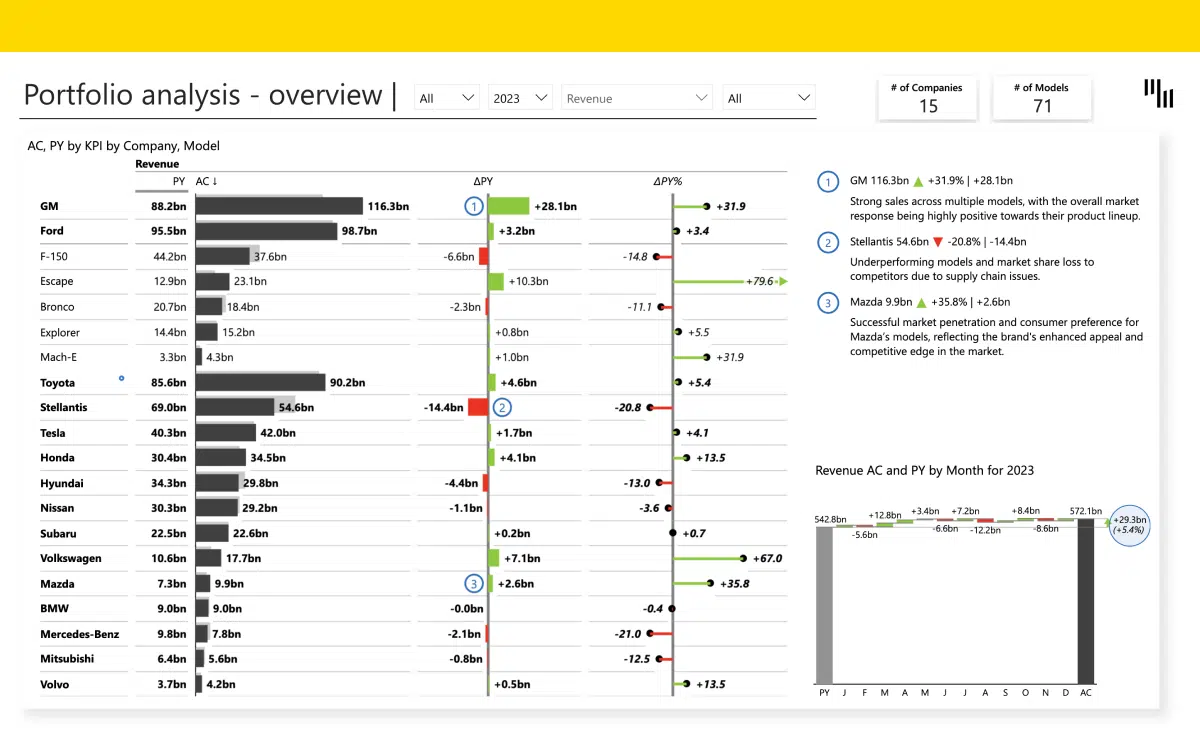

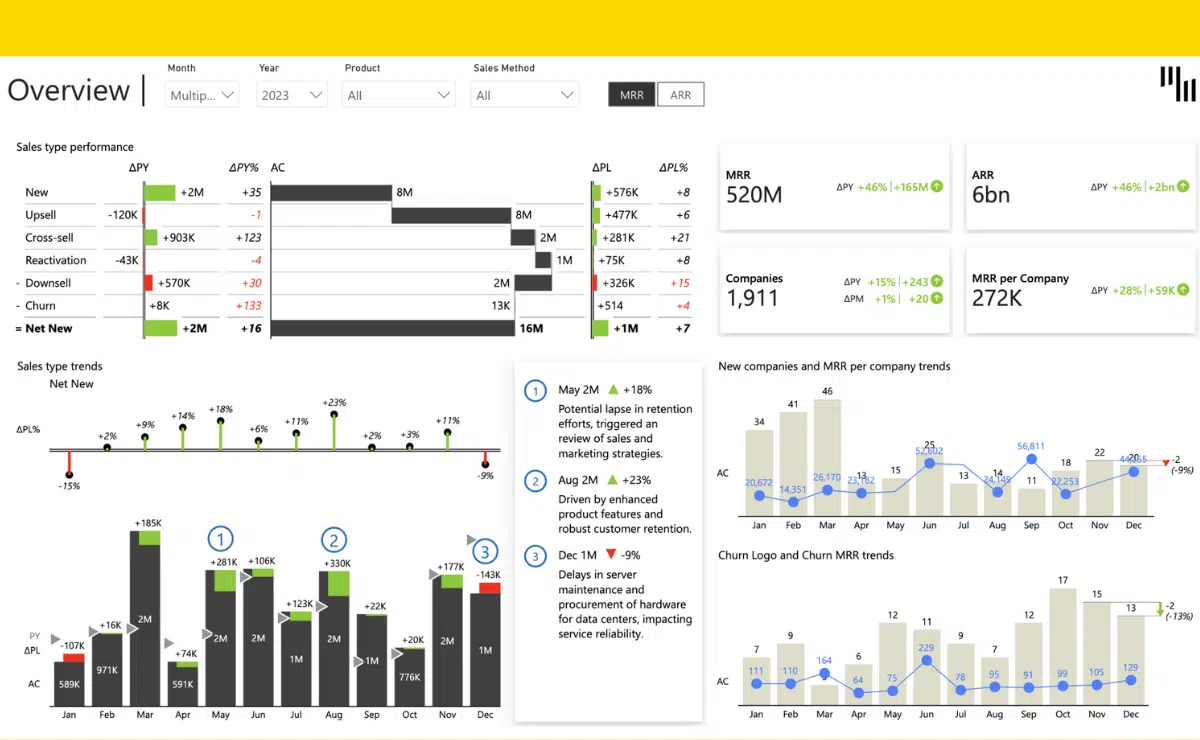

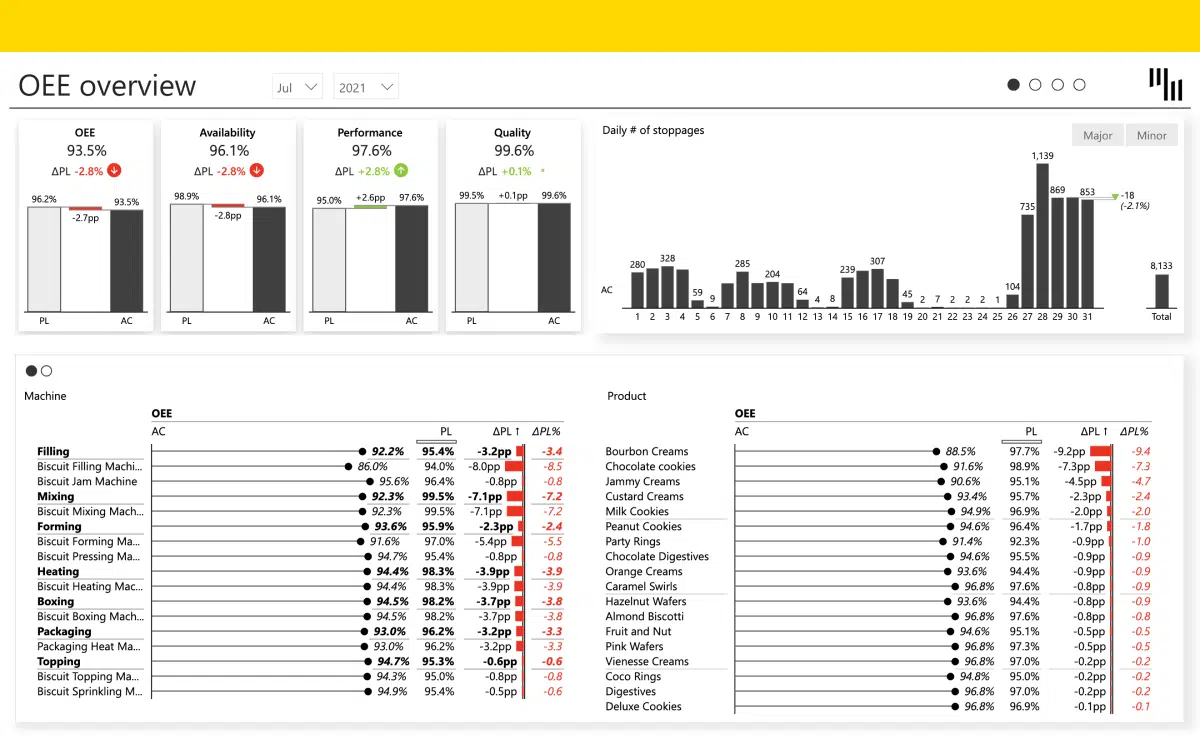

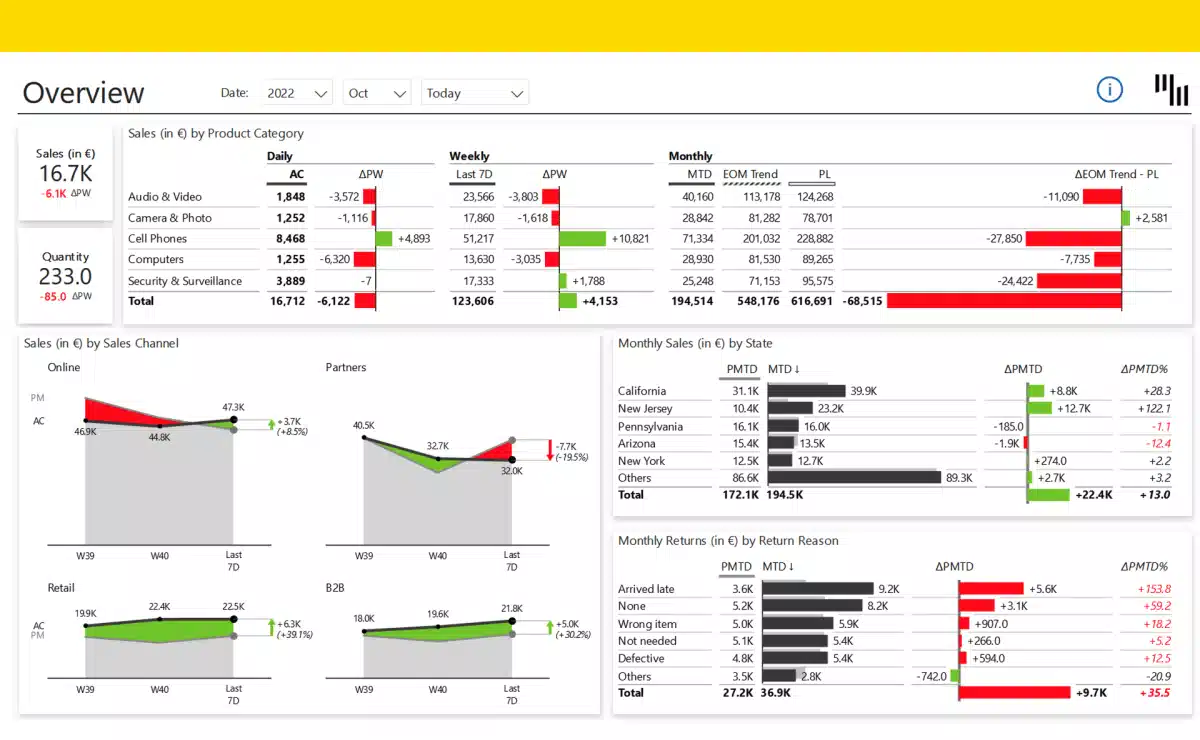

Dynamic Dashboards

Power BI, Zebra BI, and more to track multi-bank balances, outstanding positions, and short/mid/long-term forecasts.

-

Real-Time Gap Analysis

Compare forecasts vs. actuals instantly and act before risks escalate.

-

Client & Supplier Intelligence

Anticipate late payments, optimize negotiations, and strengthen financial planning.

Compatibility with Your Systems

Our solution integrates seamlessly with your financial and banking ecosystem:

-

ERP & Accounting systems

Connect directly with SAP, Sage, Cegid, Odoo, Oracle, and others to unify financial data.

-

Banking flows & SWIFT connections

Securely integrate daily cash movements, balances, and transactions across all banks.

-

Specialized treasury software

Interface with Kyriba, Sage XRT, TreasuryXpress, and more to enhance existing workflows.

-

CRM & Client/Supplier tools

Link receivables, payables, and customer/supplier data to improve cash visibility and forecasting.

Whatever your data sources, we connect and consolidate them into a clear, actionable financial view.

Our Simple, Effective Methodology

• Quick Audit – Review of your financial processes and cash flow streams.

• Secure Integration – Connect ERP, banks, and treasury tools with strict security.

• Dashboard Deployment – Tailored dashboards for CFOs, treasurers, and executives.

• Training & Adoption – Empower finance teams to use BI with confidence.

• Continuous Monitoring – Refine forecasts and expand KPIs over time.

Added Value for Your Teams and Company

With BI applied to treasury, you benefit from:

Real-time multi-bank visibility

Consolidate balances across all banks and entities into a single view, accessible at any time.

Lower financial risks

Detect tensions or cash gaps early and take proactive measures before they escalate into crises.

Smarter strategic decisions

Support financing, investment, and growth strategies with reliable, data-driven insights.

Reliable forecasts

Anticipate cash needs with greater accuracy, reduce uncertainty, and ensure liquidity planning is secure.

Improved communication

Share transparent, up-to-date dashboards with banks, investors, and financial partners to build trust.

Higher operational efficiency

Reduce manual reporting, free up finance teams’ time, and focus on analysis instead of data consolidation.

Result: more confidence, stronger control, and higher profitability.

Examples of our dashboards

Ready to Transform Your Dashboard?

Let’s turn your data into a competitive advantage. Book a free consultation with our experts today.

Instant insights, smarter decisions.

Frequently Asked Questions

Yes. We integrate with banking flows (including SWIFT), ERP systems like SAP, Sage, and Odoo, and specialized treasury software.

By consolidating real-time data from banks, ERP, and accounting, you can compare forecasts with actuals instantly and adjust before issues arise.

From multi-bank balances and debt positions to customer payments, arrears, and future cash flow forecasts, all KPIs are customizable.

Our dashboards are intuitive and tailored for CFOs, treasurers, and executives. With training included, adoption is fast and effective.

Clients report reduced reporting time, more reliable forecasts, improved banking negotiations, and stronger decision-making — directly improving profitability.