BI for Real Estate Developers:

manage your projects and

maximize margins

Connect your financial, commercial, and operational data

to secure investments and accelerate sales.

Your Challenge

How do you manage so many stakeholders?

A project involves 5+ actors on average (architects, banks, notaries, contractors, investors).

Can you keep budgets on track?

70% of projects exceed budget or schedule, reducing margins and trust.

Where is your data stored?

60% of developers rely on scattered spreadsheets, slowing decisions.

Do you see profitability in real time?

Most discover margin erosion only at project close.

Result: project management stays reactive, with costly surprises.

Our BI Solution

With DataVizX BI, you turn scattered information into strategic dashboards:

-

Data Connection

Integrate internal and external data: finance, sales, construction, and investor/client information.

-

Centralized Project View

Consolidate all financial, commercial, and operational data into one single source of truth.

-

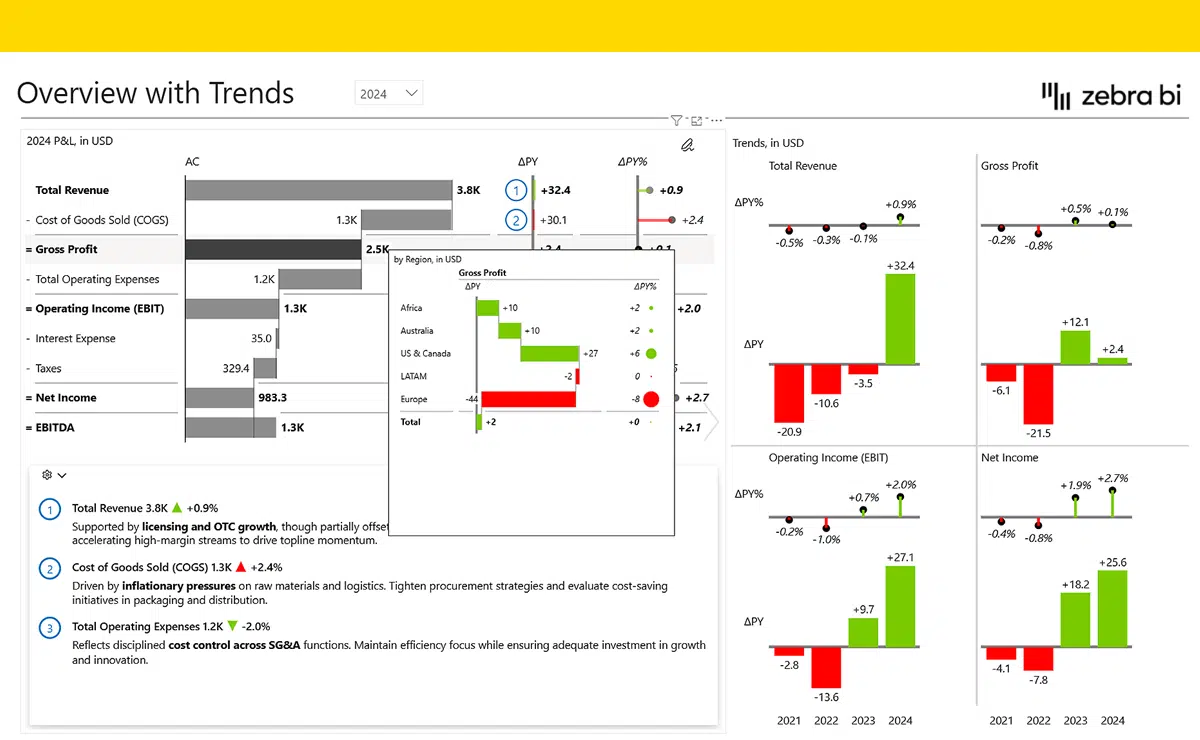

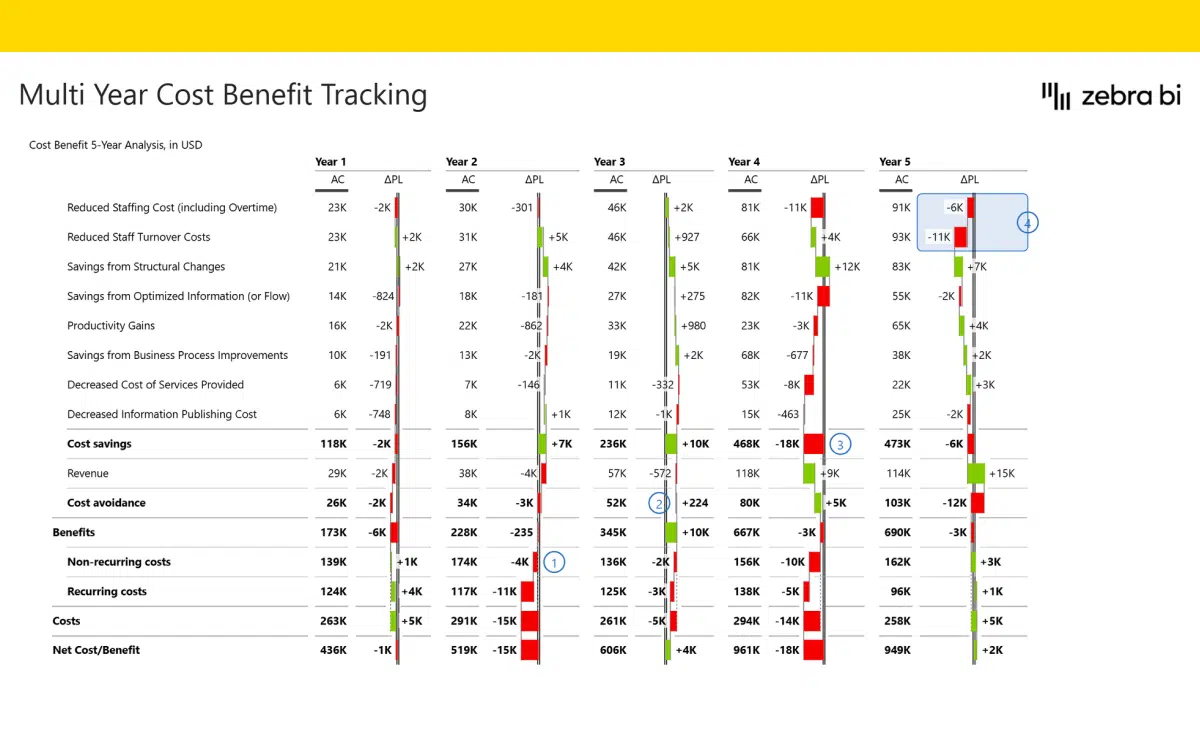

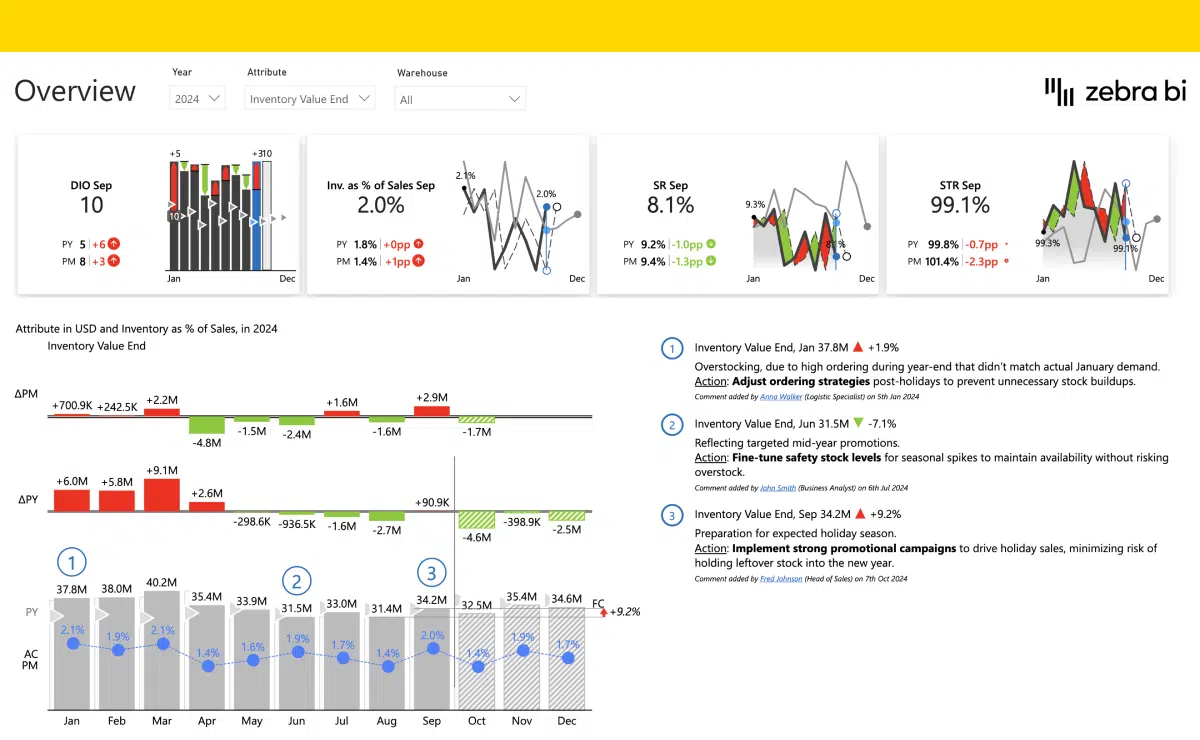

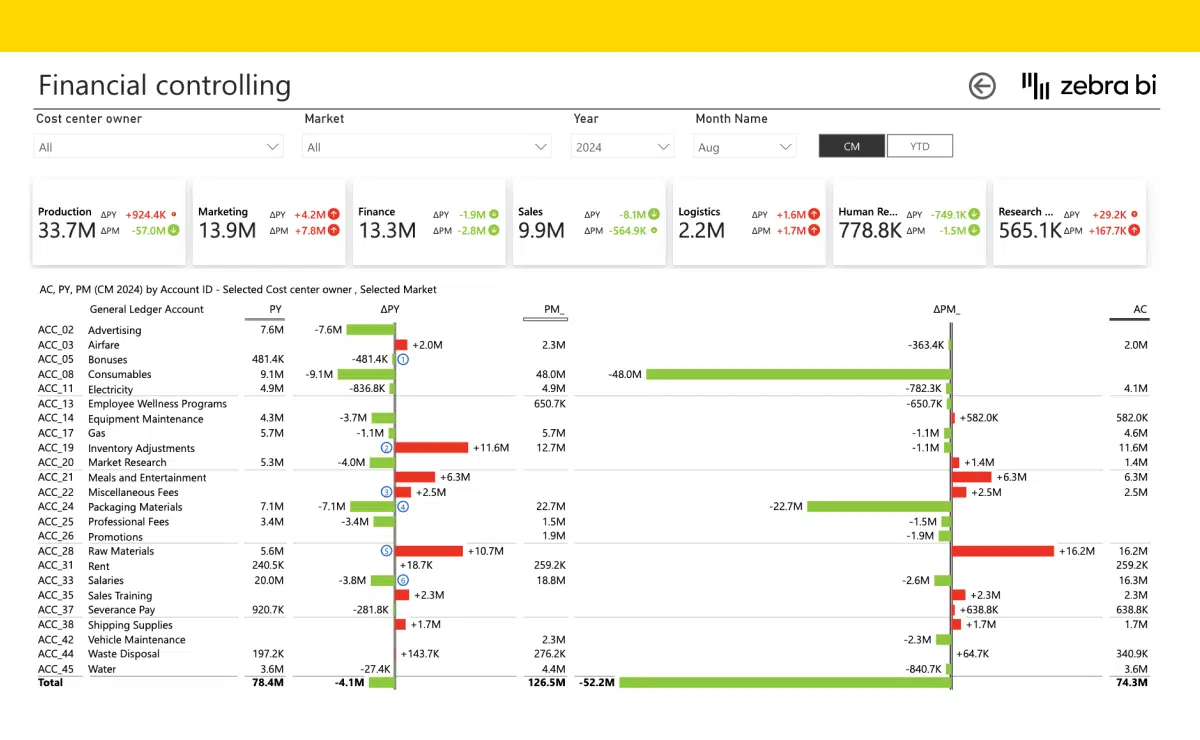

Dynamic Dashboards

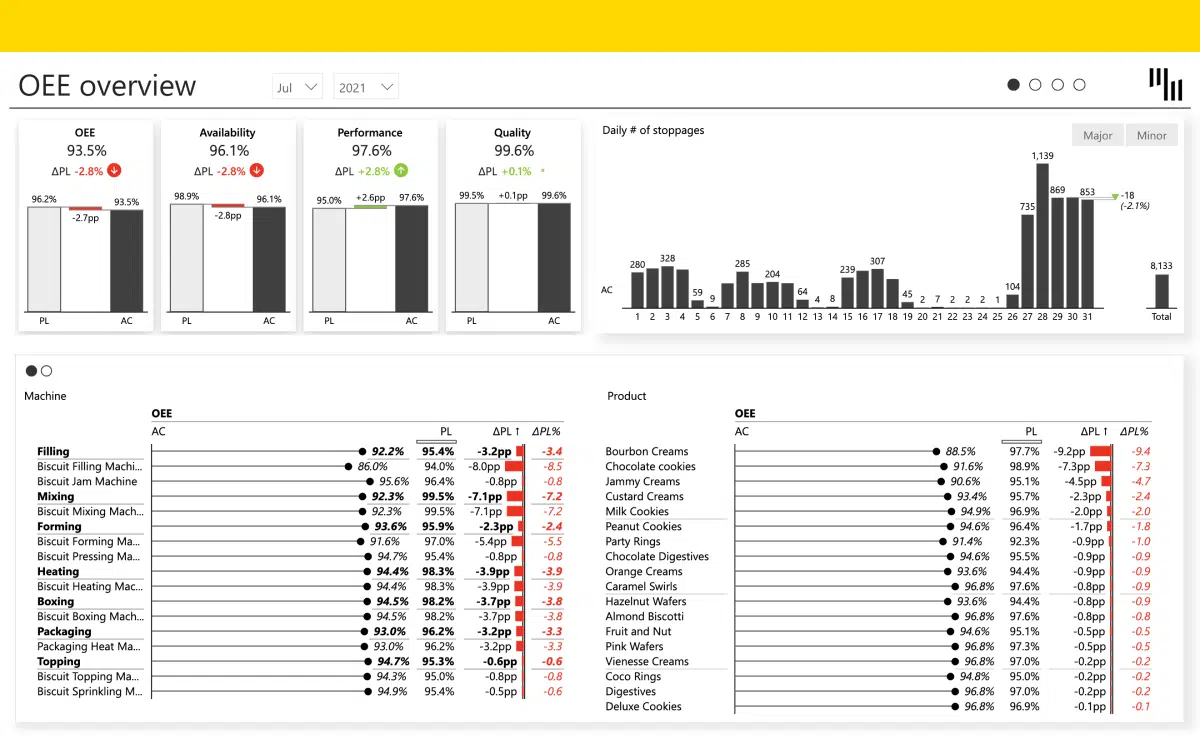

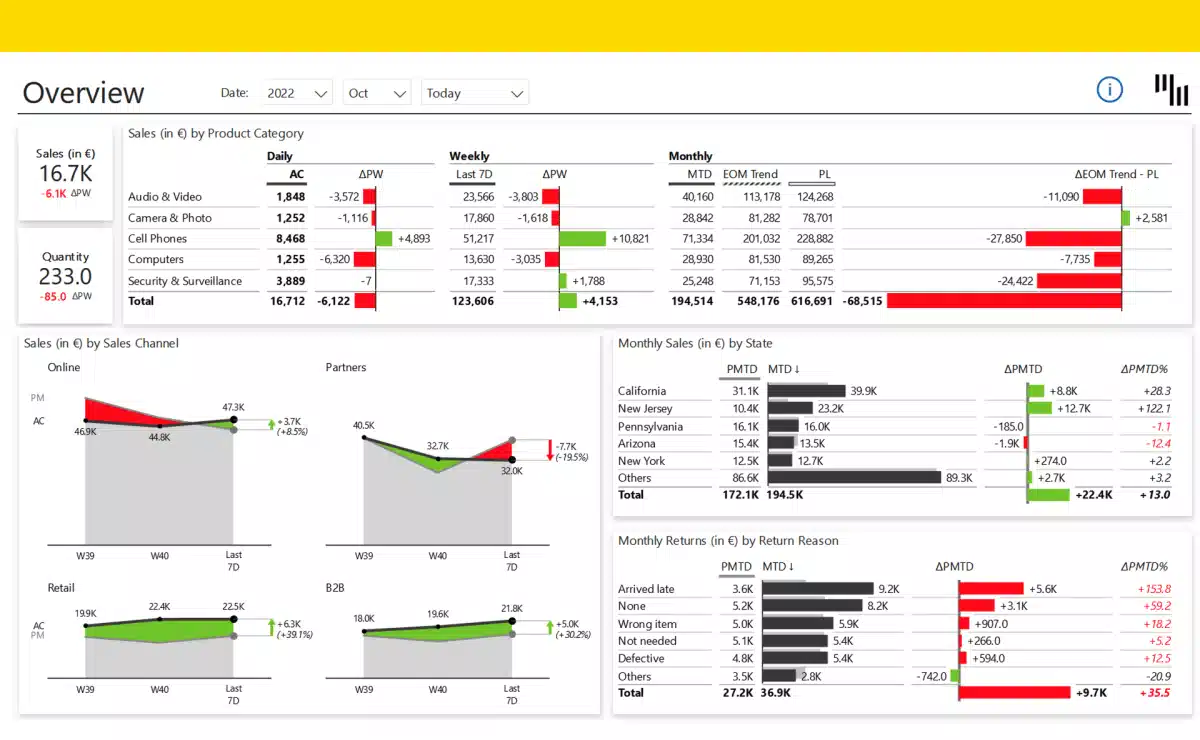

Power BI, Zebra BI, and more to monitor costs, cash flow forecasts, construction progress, and sales performance.

-

Real-Time Profitability Analysis

Track profitability at the project, building, and even individual lot level.

-

Client & Investor Intelligence

Leverage client data to target the right investors, accelerate sales, and build long-term relationships.

Compatibility with Your Tools

Our technology is designed to integrate seamlessly with real estate ecosystems:

-

Finance & ERP software

SAP, Sage, Cegid, Odoo.

-

Real estate CRMs

Salesforce, HubSpot, Sellsy, Périclès.

-

Construction project tracking

AOS, Bricks, Archidata.

-

External data sources

banks, partners, and sales agencies.

Whatever systems you use, we connect directly to your data to unlock value and improve decision-making.

Our Simple, Effective Methodology

• Quick Audit – Assessment of your projects, tools, and data sources.

• Secure Connection – Integration with financial systems, CRMs, and construction management tools.

• Dashboard Deployment – Tailored dashboards for finance, sales, and operations teams.

• Training & Adoption – Practical training for fast and confident use of BI.

• Continuous Monitoring – Ongoing KPI enrichment (sales, cash flow, project progress).

Added Value for Your Projects and Clients

By adopting BI, real estate developers gain:

Clear, real-time visibility

Monitor every project and portfolio with up-to-date dashboards, reducing uncertainty and blind spots.

Commercial performance insights

Track available lots, sales velocity, and investor targeting to accelerate sales and adjust strategy on the fly.

Enhanced decision-making capacity

Use consolidated data to plan with confidence, make proactive choices, and seize new opportunities faster.

Precise cost and margin tracking

Anticipate overruns before they happen, secure investments, and protect profitability at each stage.

Stronger investor loyalty

Deliver accurate, timely reporting that reassures investors and keeps them engaged over the long term.

Improved communication

Share transparent dashboards with banks, partners, and clients to strengthen trust and streamline reporting.

Result: projects under control, faster sales cycles, and optimized profitability.

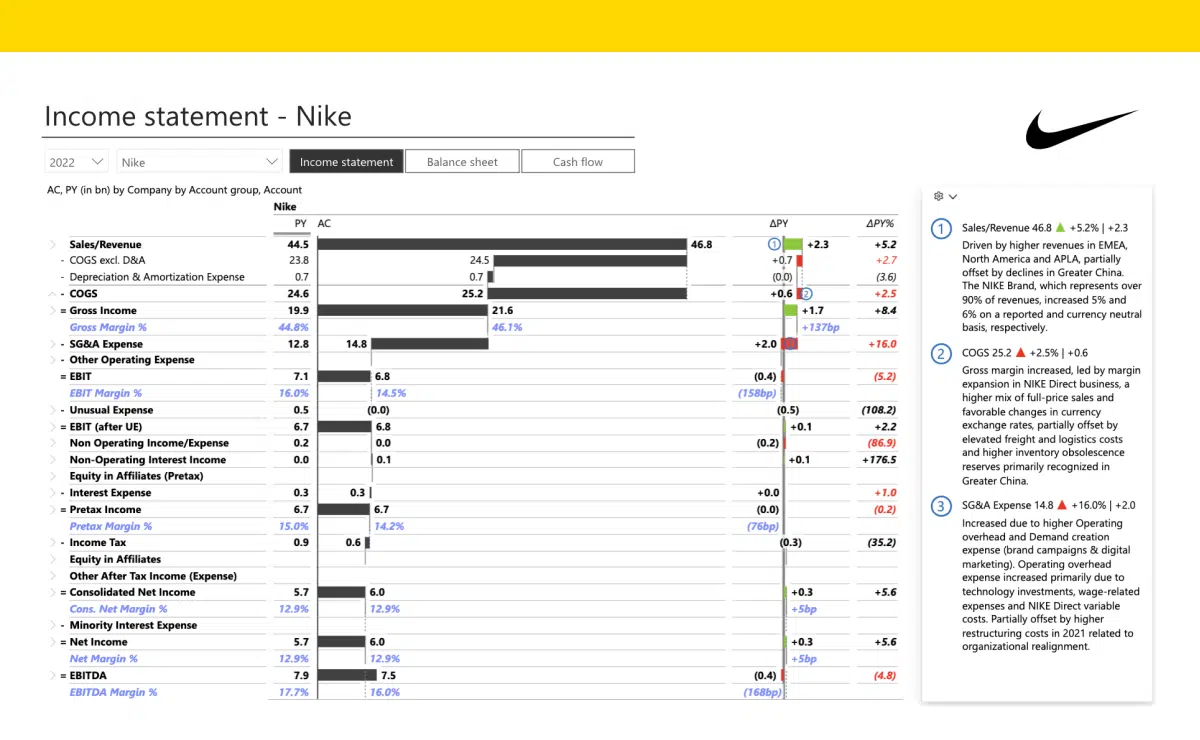

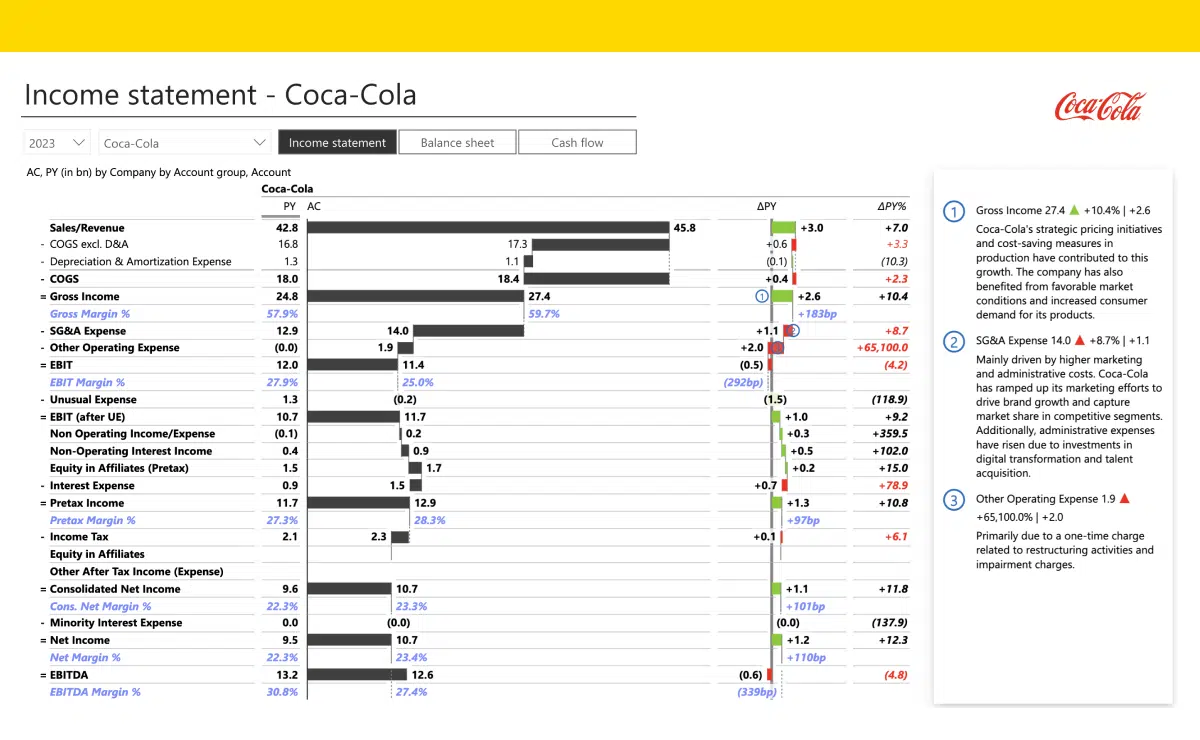

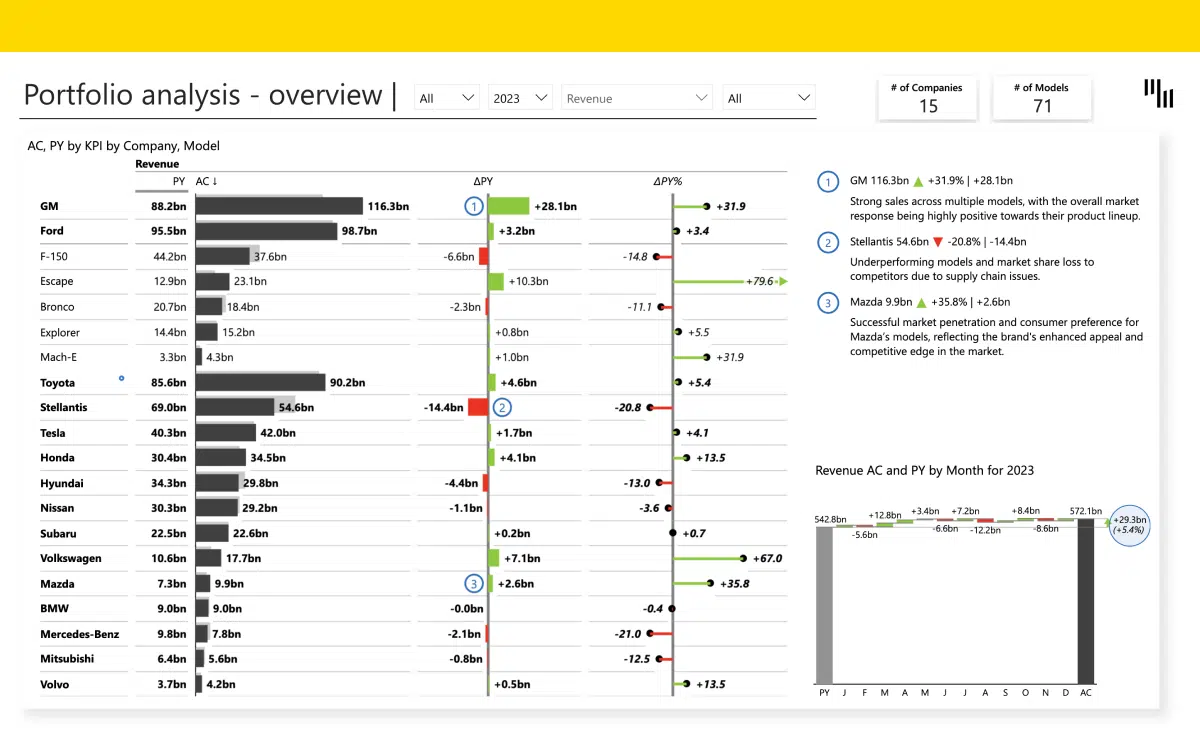

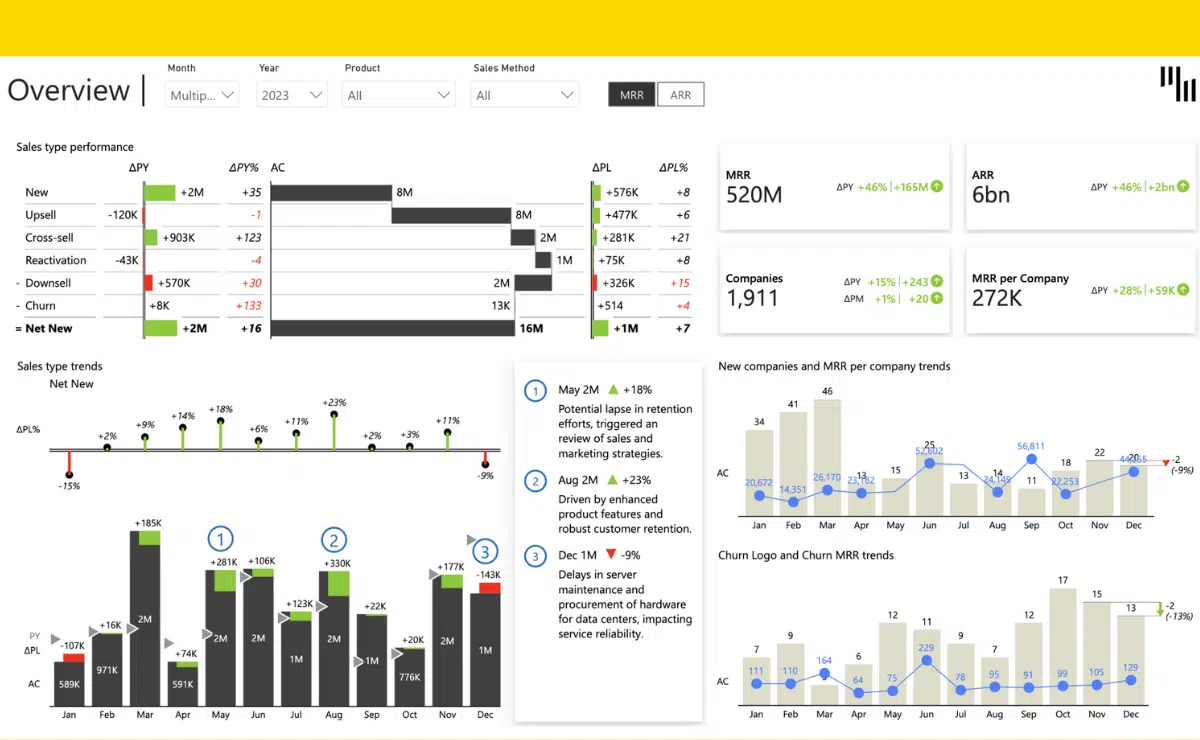

Examples of our dashboards

Ready to Transform Your Dashboard?

Let’s turn your data into a competitive advantage. Book a free consultation with our experts today.

Instant insights, smarter decisions.

Frequently Asked Questions

Yes. Our dashboards can be customized to track profitability, timelines, and sales for residential, commercial, or mixed-use developments.

By consolidating financial, sales, and construction data in real time, you gain visibility to anticipate delays, cost overruns, and margin pressure before they escalate.

Absolutely. Our platform integrates internal systems as well as external data sources like banks, agencies, and investor reporting tools.

Our dashboards are intuitive, and with training included, most finance, sales, and operations teams become proficient within days.

Clients report fewer delays, better cash flow management, faster sales cycles, and improved relationships with investors and banks — directly boosting profitability.