BI for Chartered Accountants:

save time, create more value,

strengthen client loyalty

Connect your firm’s and your clients’ data to turn

information into real performance drivers.

Your Challenge

Are you losing valuable hours reprocessing scattered data?

Over 65% of chartered accountants say they spend several hours each week consolidating information from disconnected systems instead of focusing on higher-value tasks.

Is it getting harder to prove your advisory value?

Nearly 70% of firms struggle to clearly demonstrate the strategic role of advisory services in a profession where automation is accelerating.

Are siloed tools limiting your global view?

More than 60% of accounting professionals report that closed, fragmented software prevents them from gaining a complete picture of their clients’ businesses.

Result: less time to advise clients — precisely what they expect most.

Our BI Solution

With our solution, you turn data into added value:

-

Data Connection

Seamlessly connect both firm and client data to build a complete, unified view.

-

Centralization

Bring all financial and operational information together in one single, accessible place.

-

Automation

Enjoy interactive dashboards (Power BI, Zebra, etc.) that update automatically, without manual effort.

-

Real-Time Insights

Monitor the performance of your clients’ businesses — and your own — instantly, with live analysis.

-

More Productivity

Free your teams from repetitive processing tasks so they can focus on delivering high-value advisory services.

Compatibility with

Your Business Software

Our technology works seamlessly with the accounting ecosystem and client data:

-

Accounting software

Sage, Cegid, Quadratus, ACD, Agiris, MyUnisoft, Pennylane…

-

Office & BI tools

Excel, Power BI, Zebra.

-

Connectors & APIs

smooth integration with CRM, ERP, and client applications.

Whatever tools you or your clients use, we connect directly to the data to unlock its value.

Our Simple, Effective Methodology

• Quick Audit – Analysis of your needs and data sources (firm + clients).

• Secure Connection – Integration with accounting software and client tools.

• Dashboard Deployment – Personalized KPIs and interactive reporting.

• Training & Support – Empowering your teams to adopt BI.

• Continuous Monitoring – Enriching KPIs and use cases over time.

Added Value for Your Clients

By offering BI, you provide them with:

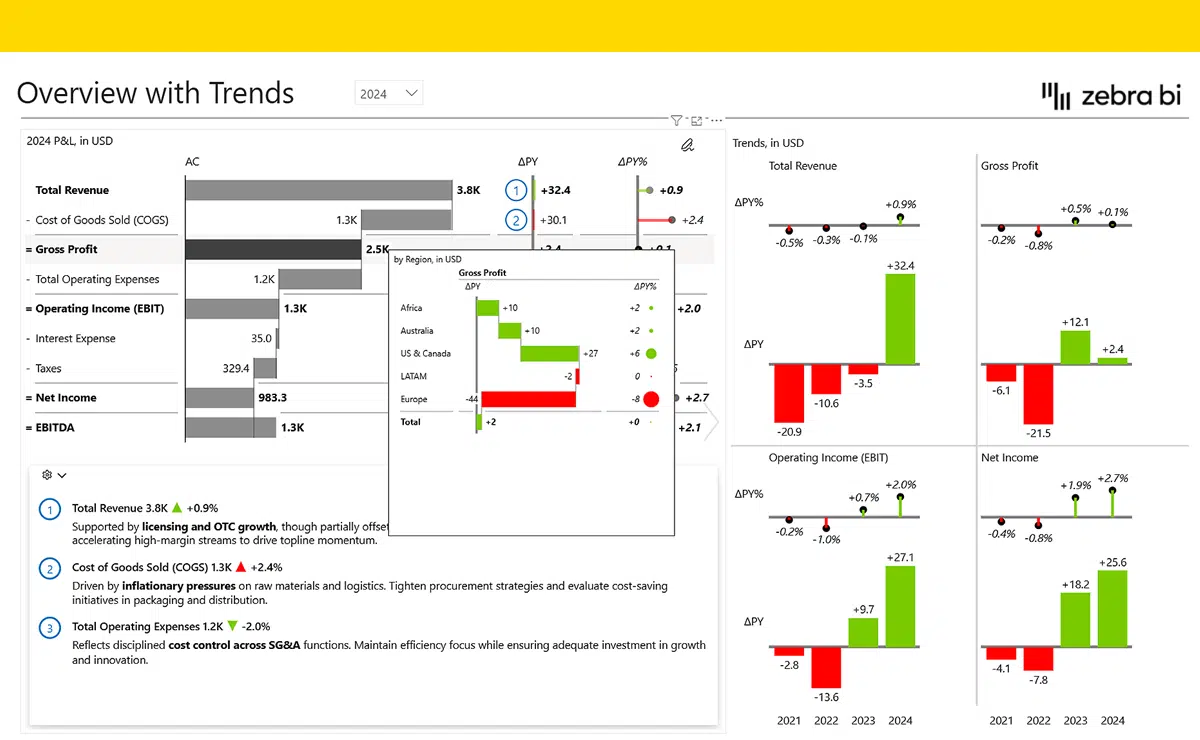

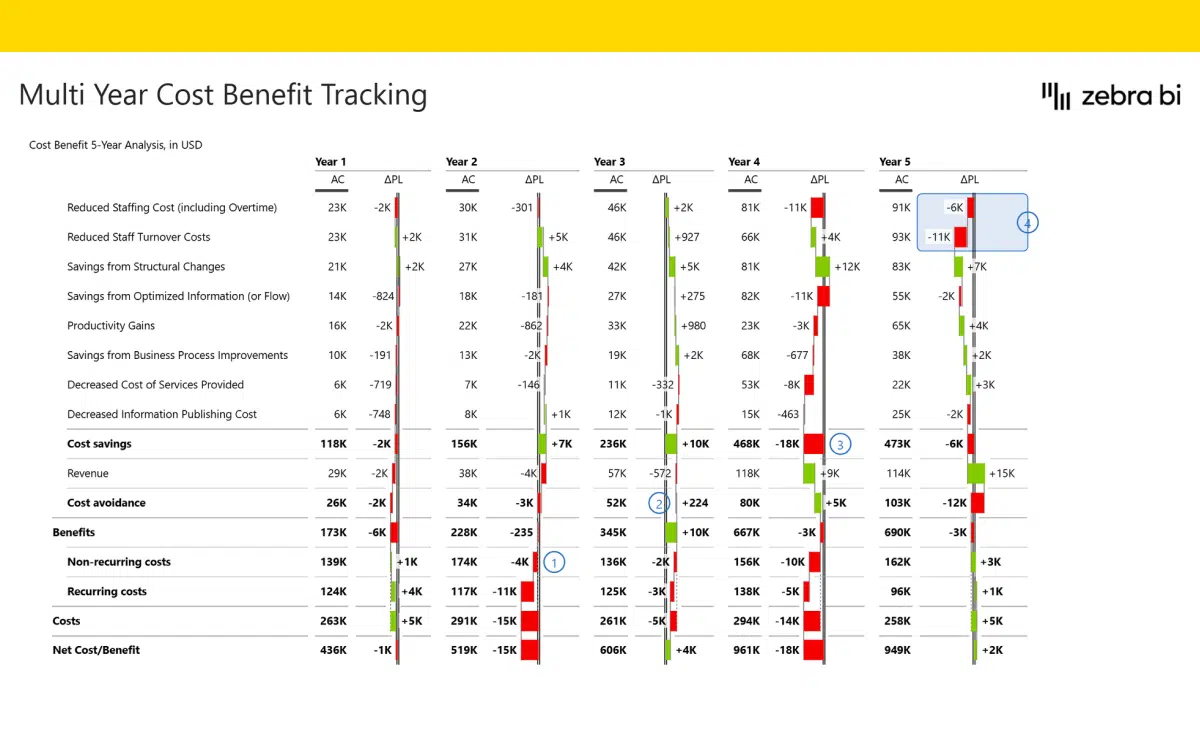

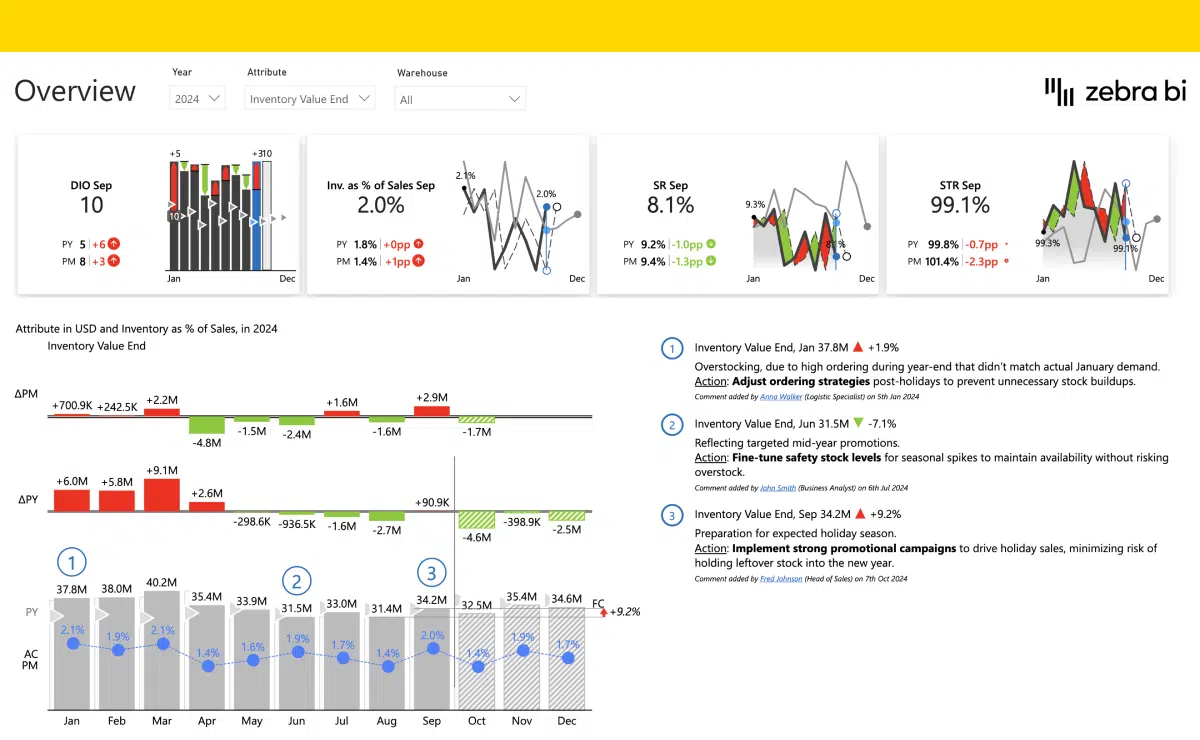

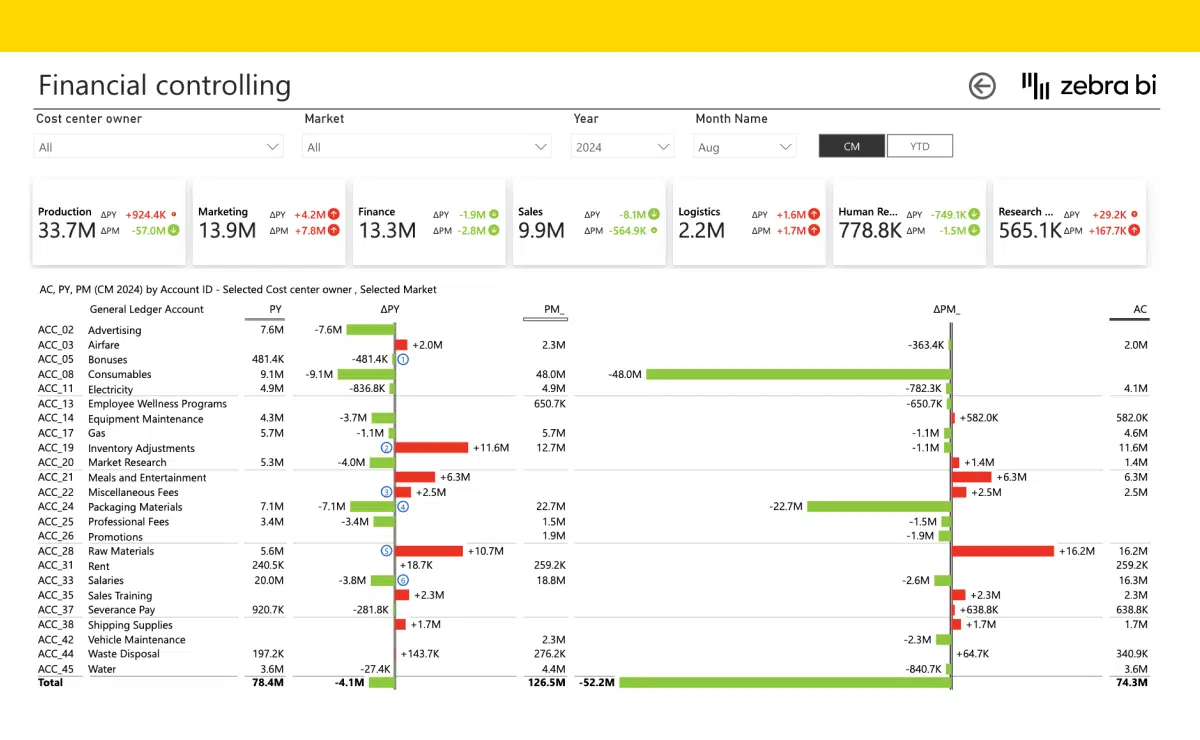

Real-time KPIs

Instantly track essential financial indicators such as cash flow, profitability, and break-even points, so clients always know where they stand.

A clear and accessible view of their business

Replace complex spreadsheets with visual dashboards that present data simply, without technical jargon.

An accountant who becomes a strategic growth partner

Move beyond compliance by using BI insights to advise on performance, growth opportunities, and risk management.

The ability to leverage their own data

Turn client data into a decision-making tool, enabling smarter strategies based on facts rather than estimates.

Result: more trust, more loyalty, more referrals.

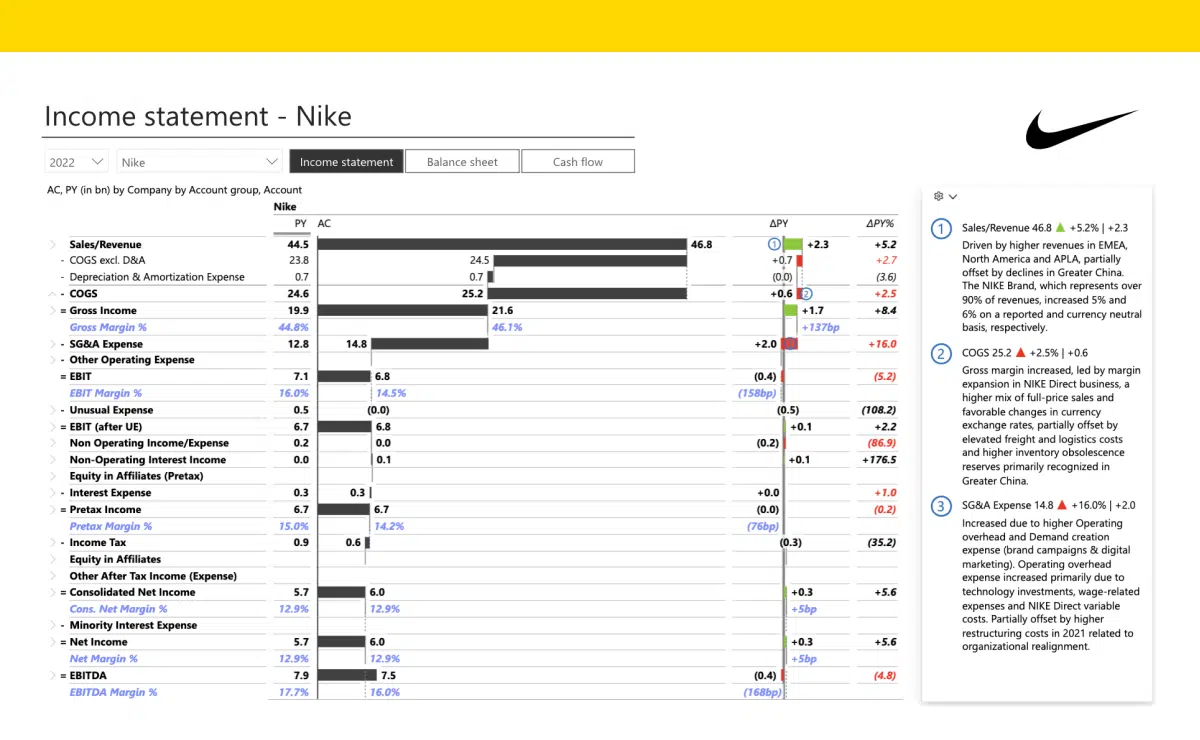

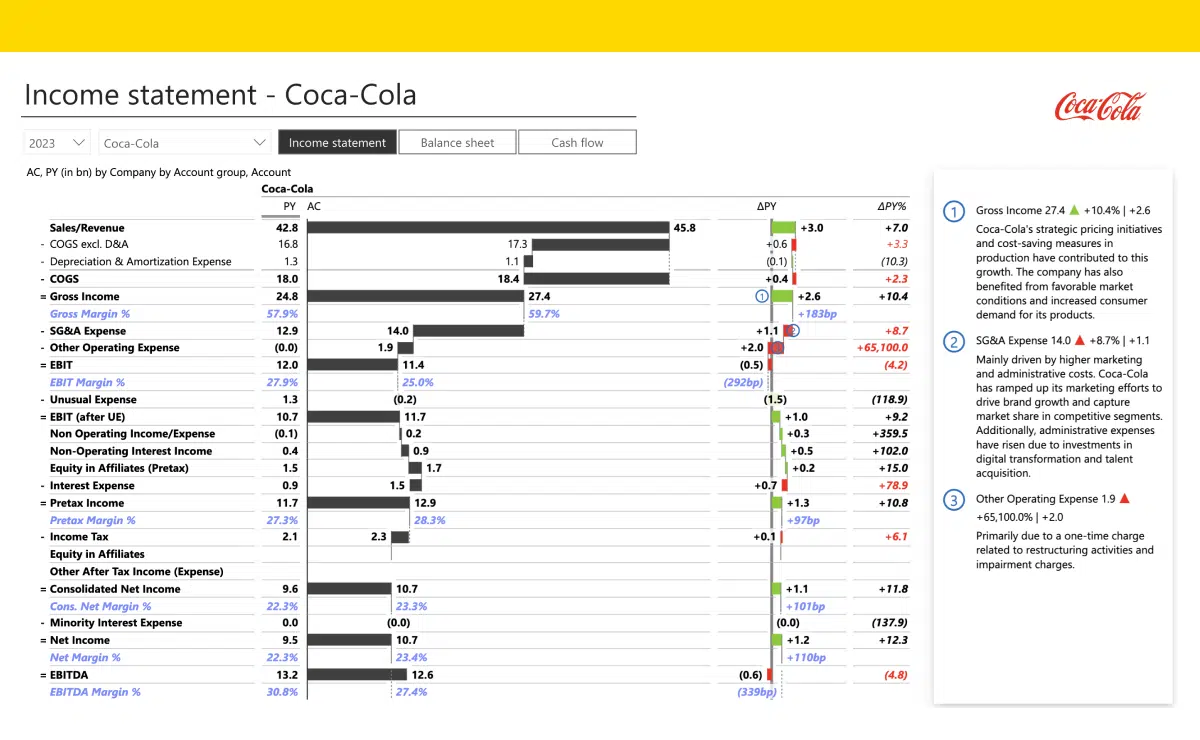

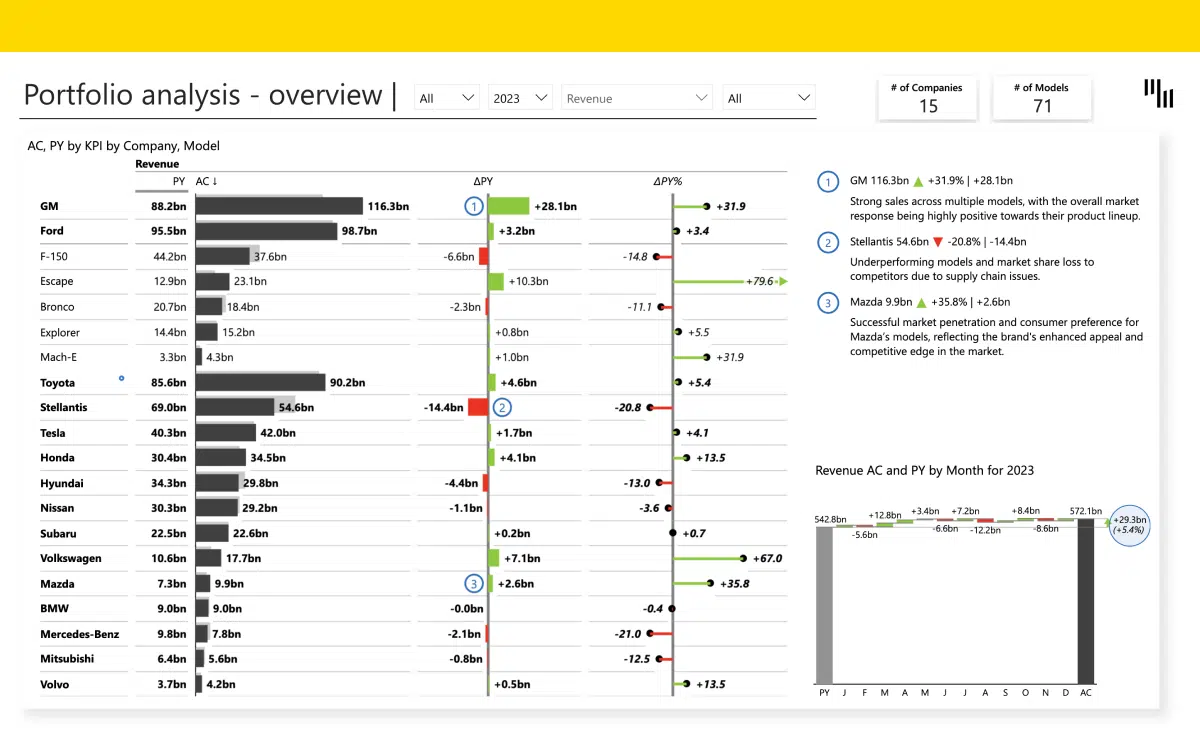

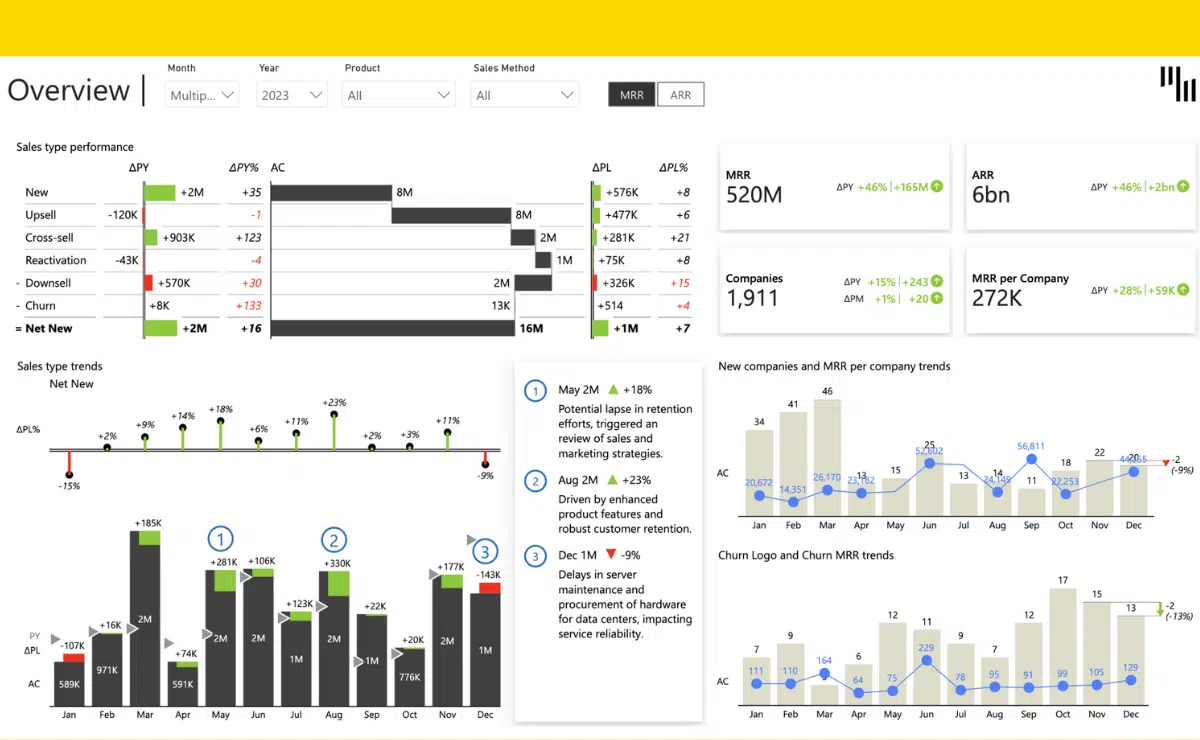

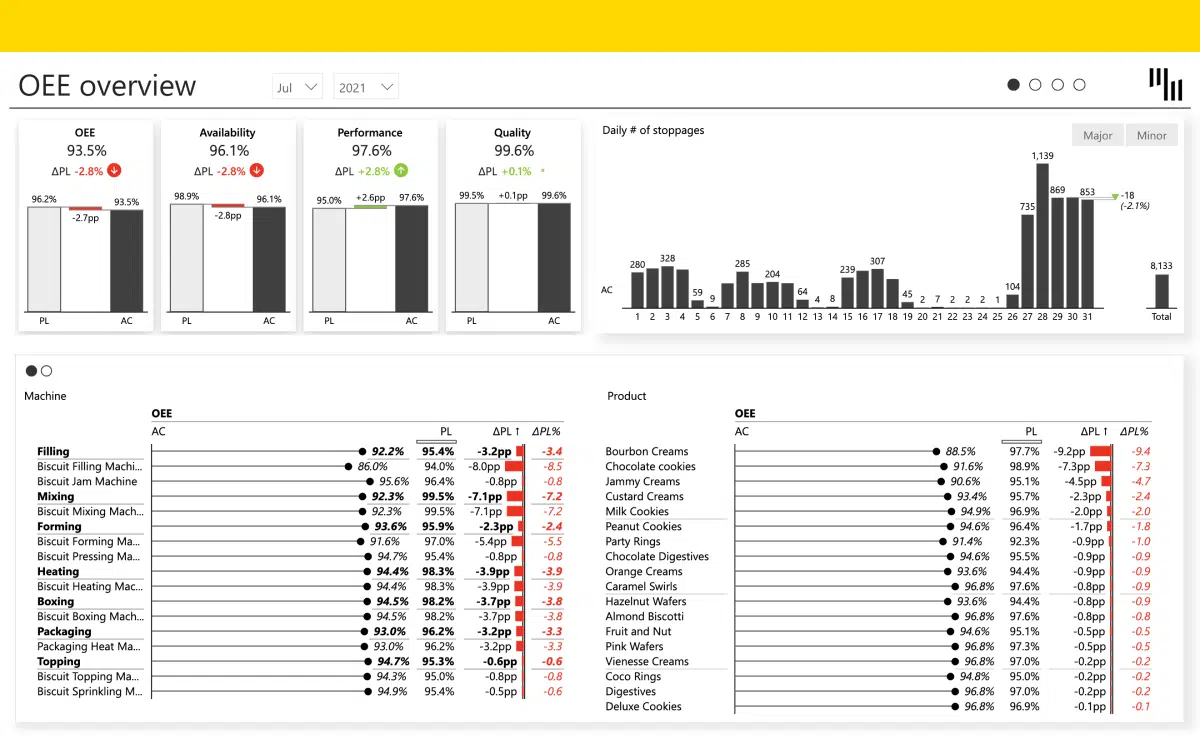

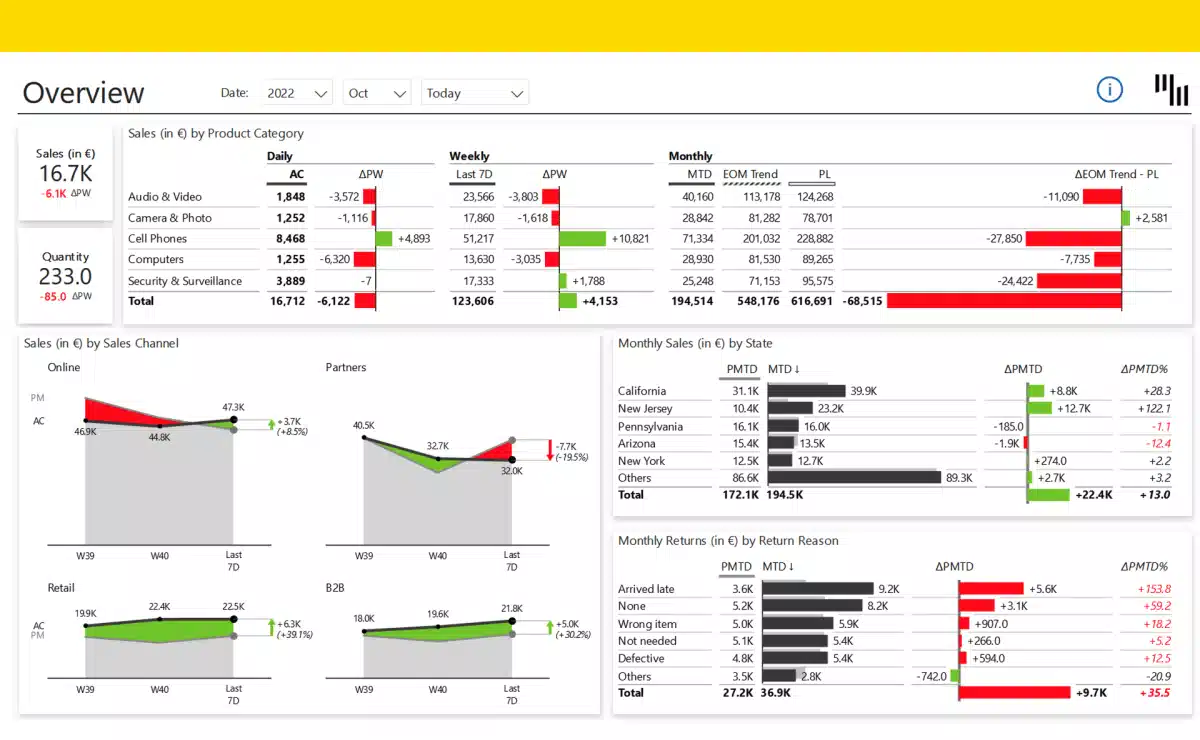

Examples of our dashboards

Ready to Transform Your Reporting?

Let’s turn your data into a competitive advantage. Book a free consultation with our experts today.

Instant insights, smarter decisions.

Frequently Asked Questions

Not at all. Our dashboards are designed to be intuitive, and we provide full training so your teams can adopt them quickly.

Yes. We integrate with major solutions such as Sage, Cegid, Quadratus, ACD, Agiris, MyUnisoft, and Pennylane, as well as Excel, Power BI, and Zebra BI.

Most firms can be up and running in just a few weeks, thanks to our proven methodology: quick audit, secure connections, dashboard deployment, training, and follow-up.

Your clients gain real-time KPIs, clear and accessible dashboards, and stronger advisory support from you — making you a true strategic partner.

Yes. We provide continuous monitoring, KPI enrichment, and advisory sessions to ensure your BI system evolves with your needs.